Ppp Loans House Vote

House of Representatives on Tuesday night passing in a 415-3 vote that sends the legislation to the Senate for consideration. The House approved the measure 71-36.

Paycheck Protection Program Ends Nh Business Review

The addition of the unemployment benefit made Rep.

Ppp loans house vote. Lawmakers in the House today are scheduled to vote on legislation to ease restrictions on how businesses use the Small Business Administrations SBA paycheck protection program PPP. House committee votes to exempt PPP grants from business taxes. While still encouraging the Senate to take up the massive 3 trillion HEROES Act passed by the House last week House Speaker Nancy Pelosi D-CA at her weekly press conference indicated that the House next.

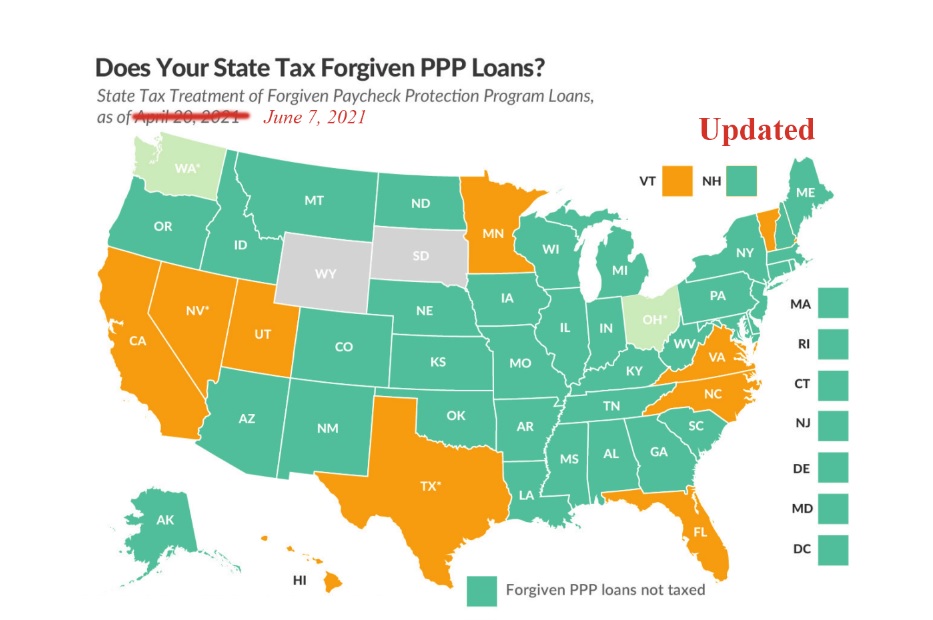

The bipartisan 23-0 vote to approve Senate Bill 3 without amendment indicates the measure is likely to pass the full House next week and be sent to Gov. Fter four work sessions and a lot of angst the House of Ways and Means Committee voted unanimously to exempt New Hampshire businesses from paying taxes on forgiven Paycheck Protection Program loans. The bill reinstates the expense addback for PPP loan recipients effective January 1 2021.

House to vote on PPP changes today. Charles Graham D-Robeson whose home health care business took a PPP loan of more than 700000 waver on an initial decision to. The House-passed measure now goes to.

CONCORD After spending a month parsing the details of a bill to exempt Paycheck Protection Program grants from business profits tax liability the House Ways and Means Committee Tuesday voted unanimously to approve the unamended bill. Senate Bill 3 would put New Hampshire in step with about 40 other states and the federal government in exempting the money from forgiven PPP loans. Chris Sununu for his.

Join representatives from the US. The House is expected to vote next week on a narrow bipartisan bill that would give more flexibility to small businesses that receive forgivable loans from the Paycheck Protection Program. With the Paycheck Protection Program PPP set to expire on March 31 lawmakers have struck a deal to extend the program for two months through the end of May.

Under a reworked House-version of the Paycheck Protection Program Flexibility Act of 2020 the 8-week period for businesses to use PPP funds would be. Moments later the House voted 111-2 to approve the bill on second reading. Brownstein Client Alert March 11 2021.

House Republican and Democratic lawmakers were joined by a host of business owners at a news conference on April 15 to praise the legislation. A bill to move the Paycheck Protection Program application deadline from March 31 to May 31 sailed through the US. The PPP Extension Act of 2021 also gives the SBA an additional 30 days beyond May 31 to process those loans.

Washington DC Today Representative Derek Kilmer WA-06 voted to support the Paycheck Protection Program and Health Care Enhancement Act to deliver additional assistance to Washingtons small businesses and frontline health care workers while. CONCORD After spending a month parsing the details of a bill to exempt Paycheck Protection Program grants from business profits tax liability the House Ways and Means Committee Tuesday voted unanimously to approve the unamended bill. Leaders of the House Small Business Committee Chair Nydia Velázquez D-NY and Ranking Member Blaine Luetkemeyer R-MO agreed to the deal today and the House is set to vote.

Cheney OrrBloomberg The House voted Thursday to give small businesses financially strapped by the Covid-19 crisis more flexibility to spend forgivable loans for payrolls and expenses. Small Business Administration SBA as they review the new funding opportunities available including the Paycheck Protection Program PPP Loans the SBA Debt Relief and Express Bridge Loans and the Economic Injury Disaster Loans EIDL and. House vote targets subprime lenders.

The House of Representatives plans to vote next week on stand-alone legislation that would ease the rules for businesses taking advantage of the Paycheck Protection Program. House representatives are voting Thursday on a 484 billion coronavirus relief package that will boost the tapped-out small business loan program the latest effort by lawmakers to bolster the. Senate Bill 3 would put New Hampshire in step with about 40 other states and the federal government in exempting the money from forgiven PPP loans.

Senate Bill 116 also would make expenses paid using a loan forgiven under the Paycheck Protection Program PPP tax deductible. Washington CNN The House voted on Thursday to pass bipartisan legislation to make changes to the Paycheck Protection Program set up to help. The nearly unanimous vote came after several dozen business groups including the AICPA endorsed the PPP Extension Act of 2021 HR.

The PPP Extension Act would also give the Small Business Administration SBA until June 30 2021 to process PPP applications. Borrowers to refinance loans due to reset at higher interest rates and make it almost impossible for poor people to get loans to buy a house. House of Representatives voted to pass the Paycheck Protection Program PPP Extension Act which would extend the deadline for businesses to apply for PPP loans until May 31 2021.

042320 Kilmer Votes to Provide Support for Washington Small Businesses and Frontline Workers Increase Testing Capacity. On Tuesday March 16 2021 the US.

Ppp Extension Changes Likely To Come Soon

Ppp Extension Likely Extending To May 31 More Time To Get Ppp Loans Youtube

Nearly A Quarter Of Nc House Members Have Close Ties To Companies With Ppp Loans Wral Com

House Ways And Means Considers Cap On Ppp Loan Forgiveness Indepthnh Orgindepthnh Org

Ppp Loan Faqs For Small Business Small Business Trends Worldnewsera

Ppp Forgiveness Changes Passed As Trump Signs Bill

What Kind Of Smallbusiness Lending Help Do You Need Small Business Loans Commercial Lending Sba Loans

New Hampshire House Panel Oks Bill To Exempt Ppp Loans From Taxation Nh Business Review

A Tremendous Success As Ppp Loan Program Comes To An End Local News Elpasoinc Com

Sununu To Sign Bill Making Forgiven Ppp Loans Tax Exempt Nh Business Review

How Can Ppp Loans Help Small Business Owners Blurbgeek

Simplified Forgiveness Application For Ppp Loans Under 0 000 Sciarabba Walker Co Llp

As Pandemic Lingers Ppp Loans Slow To A Trickle Dbt

13 Investigates Ppp Loans For 1000s Of Churches Sba Bends Rules Abc13 Houston

House Passes Bill To Give Small Businesses More Flexibility In Spending Ppp Loans

Sba Announces Simplified Ppp Loan Forgiveness The Real Economy Blog

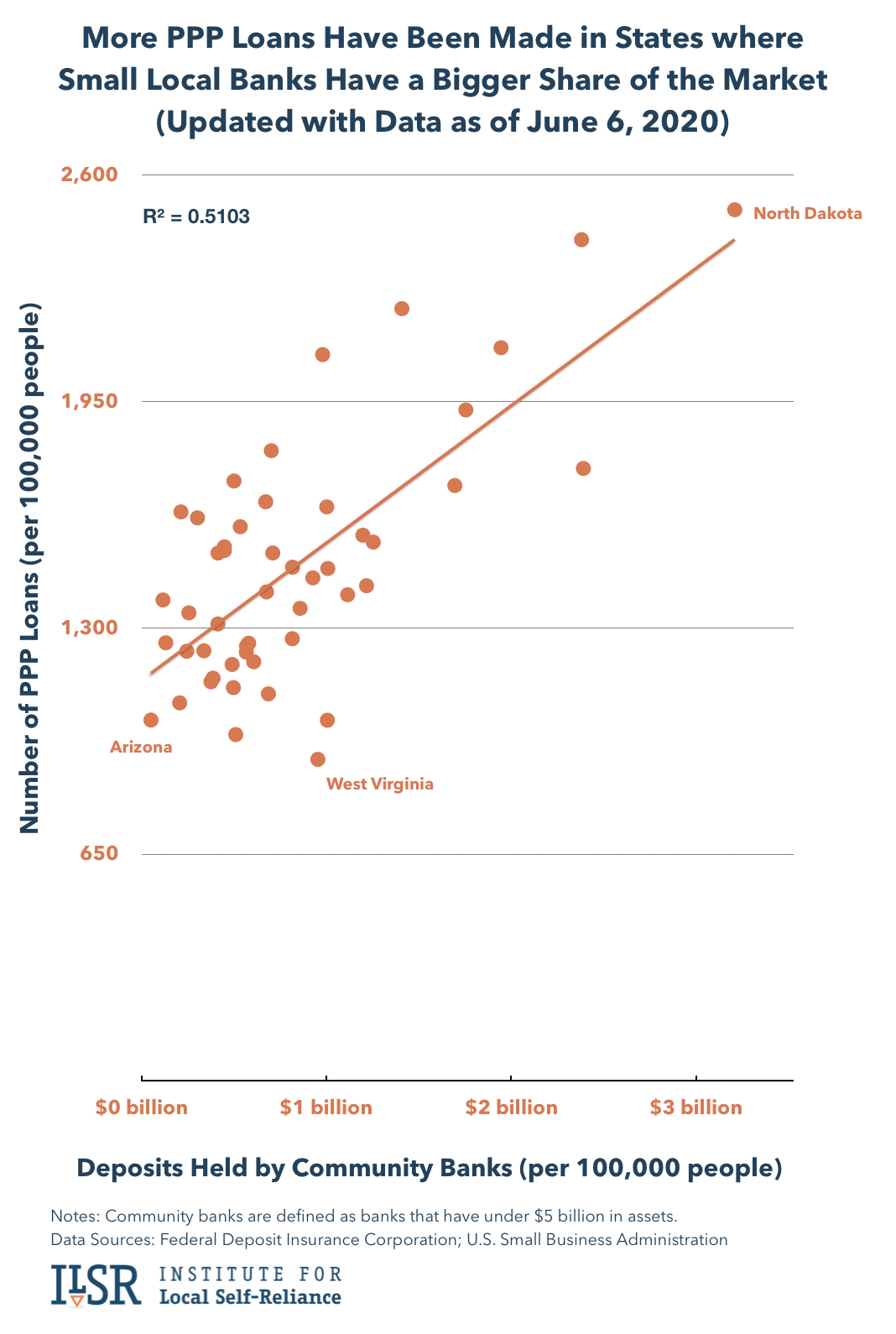

Update Ppp Loan Data Continues To Show That Big Bank Consolidation Has Hampered Small Business Relief Institute For Local Self Reliance

Ppp Loan Forgiveness May Hinge On Mandatory Osha Compliance Personnel Concepts Blog

Post a Comment for "Ppp Loans House Vote"