Can You Refinance Your Home If You Have A Home Equity Loan

Although you can sometimes refinance with less than 20 equity your. There are a few reasons why you might take this route.

Can You Refinance A Home Equity Loan Quicken Loans

You might instead talk to your servicer about a loan modification.

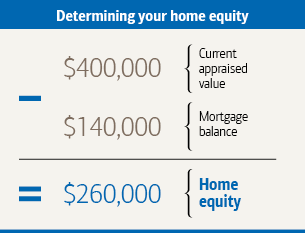

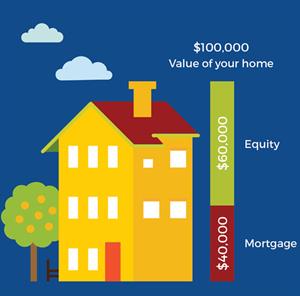

Can you refinance your home if you have a home equity loan. Refinancing and home equity loans both provide homeowners with a way to get cash based on the equity in the home. Using a home equity loan for this purpose only works for a particular group of homeowners. With insufficient equity in your home you may be limiting your options in terms of the loan amount and interest rate youll be offered during refinancing.

Generally homeowners do not simultaneously refinance their existing mortgage and take out a home equity loan. Rate Term Refinance. For the best rates you want a credit score of 700 or higher according to Experian.

How to refinance a home equity loan. You can refinance your current home equity loan into a new one with more favorable rates or payment terms. So what can you do when you want to refinance a home with low equity.

This refers to replacing your current mortgage with a brand new home loan. One significant benefit of refinancing with a home equity loan is the difference in cash paid at closing. You can refinance a HELOC by requesting a loan modification opening a new HELOC using a home equity loan to pay off your HELOC or refinancing into a.

Let us discuss how a home equity loan and a refinance works and some things you need to consider when deciding on which is the best option for you. Typically there are two methods to refinance. Your lender may limit your borrowing to 85 of your homes equity.

Another important consideration is how much home equity you have. Since a refinance is replacing your existing home equity loan with a brand-new loan you can expect to meet the same eligibility guidelines as before. This means that if you have a home worth 300000 and theres 100000 left on your mortgage you may be able to borrow up to 170000 with a home equity loan.

Youll need to have equity available to borrow from but you cant borrow the full amount. Traditional refinancing can require thousands of dollars at closing. Pros of home equity.

For the group of homeowners who have built up equity refinancing with a home equity loan could make sense in when rates are higher than you current mortgage. You have probably done sufficient damage to your credit score that even if you could refinance the interest rate you might be offered would be little better than what you are paying today. At a more basic level your equity actually determines whether youll be able to refinance or not.

Refinancing can be ideal if you intend to stay in your home for at least a year and. Youd typically do this if you wanted to turn more equity into cash lower your interest rate or extend your payment. A lesser-known use of refinancing with a home equity loan is using the loan to refinance your first mortgage.

Instead to tap the equity in your home you might be qualified for cash-out. It gets tricky if you have used the. Home equity loans can be refinanced just like traditional mortgages can.

If you already have a home equity loan with a low interest rate and a payment you can comfortably make each month then it may not make sense. 23 rows Refinancing is a way to lower your monthly mortgage payment by using a loan with a lower. You have to build up enough equity in the home to qualify for a cash-out loan which can take time Bellingham says.

One of the biggest mistakes homeowners made before the real estate market came crashing down a decade ago was taking their equity for granted. They often refinanced their homes in order to take lavish vacations or buy luxury goods when they needed to treat that equity more like a piggy bank for the long term. Youll also want to keep it a fairly low debt-to-income ratio DTI.

If you want to refinance a home equity loan it will help to have a median FICO Score of at least 680. The late payments make it unlikely that you can refinance. To save with a lower interest rate or shorter term apply for a new loan for the same amount you owe on your current loan.

Yes you can If you have enough equity in your property and can qualify for a mortgage that will pay off your 1st and 2nd mortgage Home Equity line. If you plan to stay in your home for just a few years and you have a lot of equity built up in your home then refinancing your first mortgage with a home equity loan or line of credit.

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

The 5 Best Home Equity Loans Of 2021 Money

Home Equity Loan Heloc Vs Cash Out Mortgage Refinance Nextadvisor With Time

Home Equity Loan Vs Home Equity Line Of Credit

What Is The Difference Between Cash Out Refinance Vs Heloc

Personal Business Loans Home Equity Loans Online Types Of Home Equity Lo Home Equity Loan Home Equity Home Improvement Loans

Home Equity Line Of Credit Heloc The Truth About Mortgage

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

Home Equity Loans The Pros And Cons And How To Get One

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-494330523-5a43dc60eb4d520037842ffc.jpg)

Home Equity Loans The Pros And Cons And How To Get One

/shutterstock_128332598-5bfc368646e0fb0051c03081.jpg)

Refinancing Vs Home Equity Loan What S The Difference

How To Calculate Your Home S Equity Loan To Value Ltv Tips

What Is The Difference Between Cash Out Refinance Vs Heloc

Cash Out Vs Heloc Vs Home Equity Loan The Truth About Mortgage

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

Home Equity Guide Borrowing Basics Third Federal

What Is A Home Equity Loan Or Line Of Credit Mid Hudson Valley Federal Credit Union

Reasons To Refinance Your Mortgage Freeandclear Home Equity Loan Refinance Mortgage Home Equity

Post a Comment for "Can You Refinance Your Home If You Have A Home Equity Loan"