House Appraisal Lower Than Purchase Price

Explain that you are not willing to pay more for a house than it is worth in the current market. For example say a home lists for 450000 but it only appraises for 435000.

Is A Low Appraisal Good For The Buyer

A low appraisal reduces the homes market value and the amount a bank will lend putting the buyer and seller in a difficult position.

House appraisal lower than purchase price. When there is an appraisal gap you have five options. This is not always the case. If your house appraisal is lower than the offer then there are a few steps that you might need to take.

Real estate experts estimate between 10-20 of appraisals come in lower than the sale price. Home appraisals are used for mortgage refinances as well as purchasing a new home. In some cases you can dispute the appraisal and ask for another professional review.

Many buyers put down 20 percent when they purchase a home so theres typically a cushion if the value comes in a little short. Appraised value is lower than the sales price bad The worst case scenario is when the appraisal comes in below the sales price of 400000. 100000 Old down payment.

While in a perfect world you would be able to buy a home with instant equity have all their closing costs included and bring as little cash to close as possible knowing whether a homes appraised value will exceed its purchase price is difficult to predict. You can often use the lower appraised value to negotiate a reduction in the sales price of the home. A low appraisal is bad news because the lender will only provide a loan up to the appraised value overriding your agreed-upon purchase price.

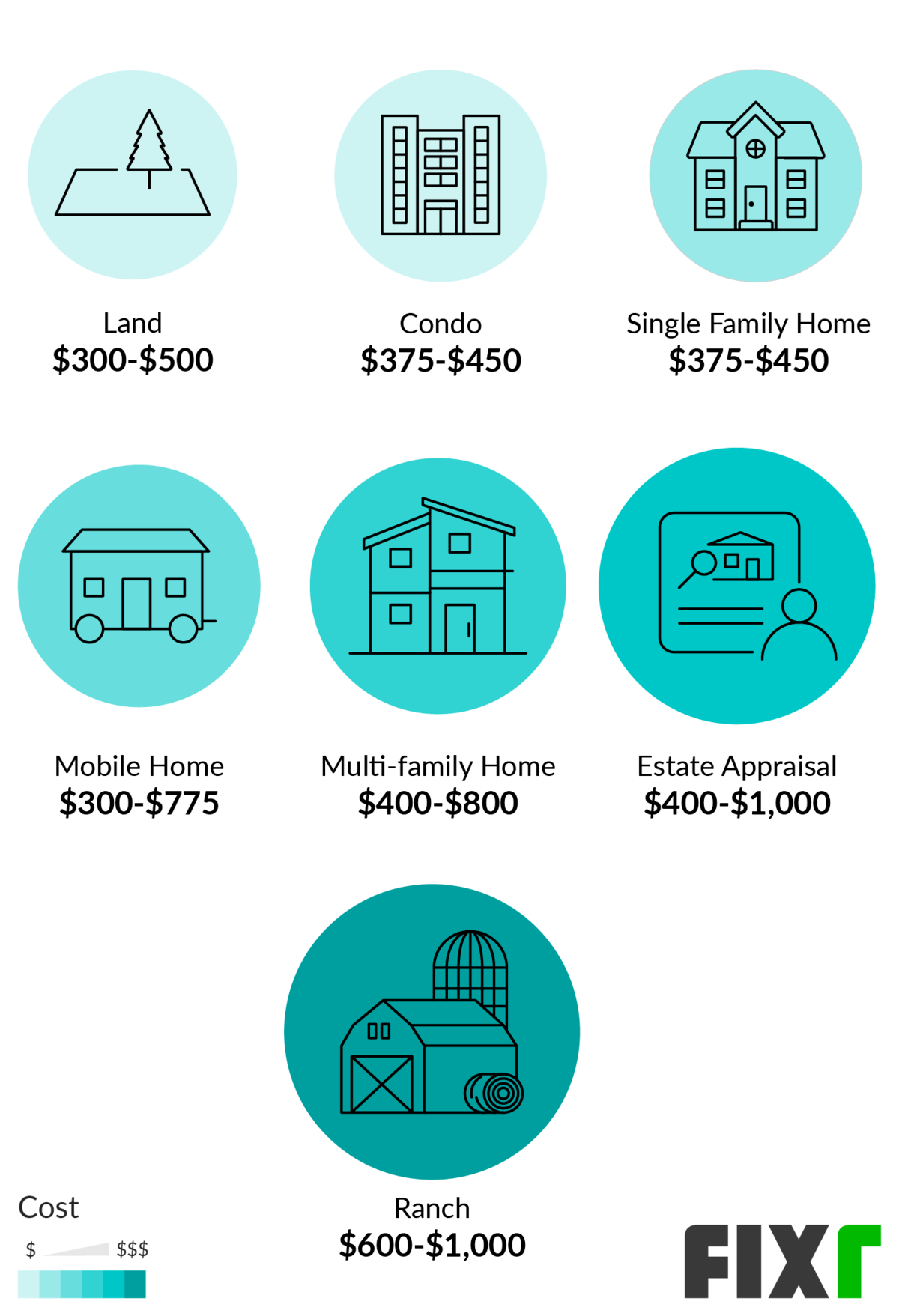

According to Bankrate A typical single-family home appraisal will cost between 300 to 450 while a home that is larger in size or is located in a big city can cost between 500 and 800. Depending on the buyers level of interest you will most likely have to lower your asking price. 22000 New down payment.

The appraisal is strong evidence that the price was above the market value of the home. Low FHA Appraisal Below Purchase Price When the appraisal comes in below the asking price there are several things you can do. Lets use a 395000 value for this example.

Or just tell them the house appraised below the agreed-upon purchase price. But in todays competitive housing market more homes are selling with multiple offers and the chances of an appraisal gap is increasing. The remaining 15000 of the home listing price is considered an appraisal gap and it needs to be covered by the buyer or seller.

If the seller wont reduce the price on the home you may want to cancel the sale Consider consulting an attorney about your options. If the appraised value comes in slightly lower than expected its not the end of the world. Give them a copy of the appraisal report if you have one.

The purpose of appraising a home is to reveal whether the price on the contract for the property is appropriate based on the location condition and features of the house. The final LTV is now 9875 380000 395000 and not the initial 95. This way your FHA lender will be willing to move forward with the loan.

What if the appraisal is lower than purchase price. The homeowner seller could reduce the selling price to match the appraised value. Going back to the example provided earlier who covers the 10000 discrepancy between your offer of 390000 and the appraisal of 380000.

Low appraisal values for home buyers When your home appraises for less than its purchase price it affects your mortgage and can affect your contract too. Sellers and buyers have several options to choose from that can help them reach a mutually beneficial agreement. Both become affected if the appraisal comes in lower than the agreed-upon selling price.

Remember that mortgage lenders use the. Its common for a home appraisal to be lower than the price a seller asks for the home. The first thing you should do as a home buyer is put the ball back into the sellers court.

So if the appraisal is less than that amount the lender uses the lower appraised amount to determine how much loan money they approve.

9 Steps To Disputing A Low Home Appraisal Gobankingrates

What Is An Appraisal And How Does It Affect The Purchase Of My Home Home Appraisal Appraisal Sale House

What Happens If The Appraisal Comes In Lower Than Expected Video Real Estate Buying Real Estate Marketing Real Estate

The Appraisal Came In Low Now What Zillow

What Home Sellers Should Know About Appraisals In 2021 Home Buying Tips Home Appraisal Home Buying

Appraisal Comes In High Or Too Low Ideal Lending Solutions

Home Appraisal Cost Average Appraisal Fee

Naftali Horowitz Appraiser Real Estate Real Estate Property Fire Damage

What Happens If My Appraisal Comes Back Under Contract Price Riverfront Appraisals

How To Remove Collections From A Credit Report Without Paying Connect Rates Home Appraisal Mortgage Lenders Fha Financing

The Appraisal Came In Low Now What Zillow

What To Do If Your Home Appraisal Comes Back Low Home Appraisal Selling Real Estate Home Buying

Free Printable Questions To Ask Your Appraiser During A Home Appraisal Homebuying Tips Home Appraisal Home Buying This Or That Questions

Saving Enough Money To Match The Sticker Price On A House Isn T The Only Cost When Buying A Home From Home Insp Buying First Home Home Buying Home Buying Tips

Appraisal Contingency For Nyc Real Estate Hauseit Nyc Real Estate Appraisal Purchase Contract

5 Things To Know About Appraisers Choosing Comps

My Home Appraised Below Purchase Price What Now

Refinance Appraisal Vs Purchase Appraisal Rocket Mortgage

Post a Comment for "House Appraisal Lower Than Purchase Price"